Introduction

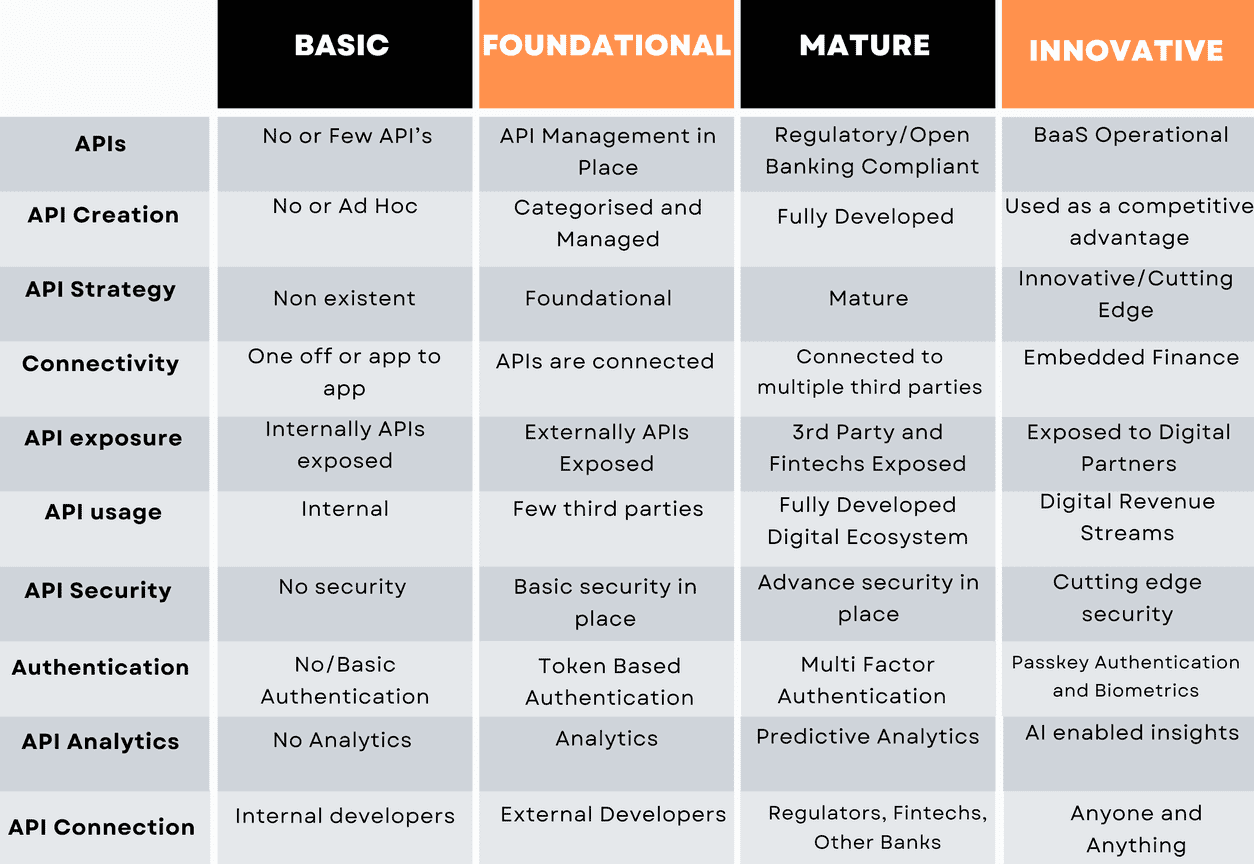

As the digital economy continues to accelerate, Application Programming Interfaces (APIs) have become fundamental to digital innovation and business agility as we step into the age of AI, this is especially true in the global banking industry. APIs empower banks to extend their services, enhance customer engagement, and drive operational efficiency by connecting various internal and external systems. However, having worked with a number of banks from all around the world for the past few years we noticed that not all banks are at the same level of API adoption. The Mitra API Maturity Model provides a strategic framework to assess where a bank stands in its API journey, guiding the institution on its next steps to progress toward digital excellence.

In this article, we explore the 4 stages of API maturity (Basic, Foundational, Mature to Innovative) that we have seen in the market. By examining this model, banking executives and decision makers can better understand their current position and chart a roadmap to becoming a digital leader in the hyper competitive banking industry. We at Mitra AI believe that these insights are crucial not only for enhancing customer satisfaction but also for future-proofing banking operations in an increasingly competitive digital environment.

1.Understanding the Mitra API Maturity Model: Four Key Stages

2.Basic Stage: The Start of Digital Transformation

At the initial stage of API adoption, banks are just beginning their journey toward leveraging APIs. Believe or not there are still a lot of banks at this stage even in late 2024. This stage is characterised by limited API capabilities, typically focused on basic functionalities like retrieving account information or checking balances. APIs at this level often lack proper documentation, governance, and security measures. Banks in the basic stage use APIs primarily to meet internal needs and often struggle with scaling their API efforts due to insufficient strategic direction.

Key Characteristics:

Basic functionalities like account inquiries.

Limited governance and security.

A lack of standardised API documentation.

Minimal or no external developer engagement.

Implications for Banks:

Banks at this stage have taken their first step toward digital transformation but face significant barriers to scaling their API capabilities. While offering enhanced customer convenience, this stage signals a need for banks to implement stronger governance and security practices to support future API development.

Mitra AI Recommendations

Key Action: Begin by implementing API governance and security frameworks. Invest in basic API documentation and standardisation processes.

Focus: Internal development, basic functionalities, and foundational API management systems.

Next Step: Build an internal API strategy that supports more advanced API use cases.

3.Foundational Stage: Building the API Strategy

As banks move into the foundational stage, they begin to standardise their API approach. APIs become more secure, well-documented, and exposed to selected third-party developers and partners. Banks at this level start recognizing the value of APIs beyond internal use and begin to structure an API strategy to support broader organisational goals.

Key Characteristics:

More structured and standardised APIs.

Exposure to select third-party developers.

Improved API security and documentation.

Beginnings of an API governance model.

Implications for Banks:

At this stage, banks can unlock new partnership opportunities by offering APIs to fintechs and other third-party developers. However, they still face challenges in fully leveraging APIs as revenue generators or scaling their use across multiple business units.

Mitra Recommendations

Key Action: Extend API offerings to select third-party developers and partners. Focus on standardising API processes and improving security measures.

Focus: Expanding API use for improved customer services, fund transfers, and third-party collaborations.

Next Step: Develop an external API strategy and build developer portals for increased engagement.

4.Mature Stage: Creating a Symbiotic API Ecosystem

In the mature stage, banks’ API capabilities are robust and widely integrated across the organisation. APIs at this level enable seamless collaboration between internal departments, external developers, and fintechs. Developer portals and API communities are established, fostering an environment of co-creation and innovation. Banks in this stage gain competitive advantages by using APIs to introduce new products and services rapidly.

Key Characteristics:

Comprehensive, well-integrated API ecosystem.

Strong developer engagement through portals and documentation.

APIs used for external collaboration and internal innovation.

APIs enable market leadership by delivering superior customer experiences.

Implications for Banks:

Banks in the mature stage reap the benefits of being at the forefront of API innovation. They can deliver seamless, personalised customer experiences across multiple channels and build an API-driven culture that fosters innovation, both internally and externally.

Mitra Recommendations

Key Action: Strengthen external API collaborations by engaging external developers and fintechs. Use APIs to foster innovation and develop new products.

Focus: API-driven innovation, market leadership, and improved customer experiences.

Next Step: Build a thriving API ecosystem by creating strong developer portals and fostering external collaborations.

5.Innovative Stage: The Pinnacle of API Leadership

The innovative stage represents the highest level of API maturity. Here, APIs are not just tools but strategic assets that enable banks to redefine their role in the financial ecosystem. Banks at this stage introduce groundbreaking products and services, leverage AI, and collaborate with a wide array of partners to co-create transformative solutions.

Key Characteristics:

APIs used as competitive advantages, driving business model innovation.

Advanced API security and governance

APIs integrated with cutting-edge technologies like AI and machine learning.

APIs generate new revenue streams through ecosystem leadership.

Implications for Banks:

Banks at the innovative stage position themselves as leaders in the digital economy. Their API strategies go beyond technical efficiency and drive business growth through data-driven insights, personalised services, and proactive problem-solving capabilities.

Mitra Recommendations

Key Action: Utilise APIs as strategic tools to create disruptive products and services. Collaborate with a broader ecosystem, leveraging data analytics and advanced security features.

Focus: Leveraging APIs for competitive advantage, driving business innovation, and exploring new revenue channels.

Next Step: Constantly innovate and look for novel ways to use APIs to stay ahead in the digital transformation journey.

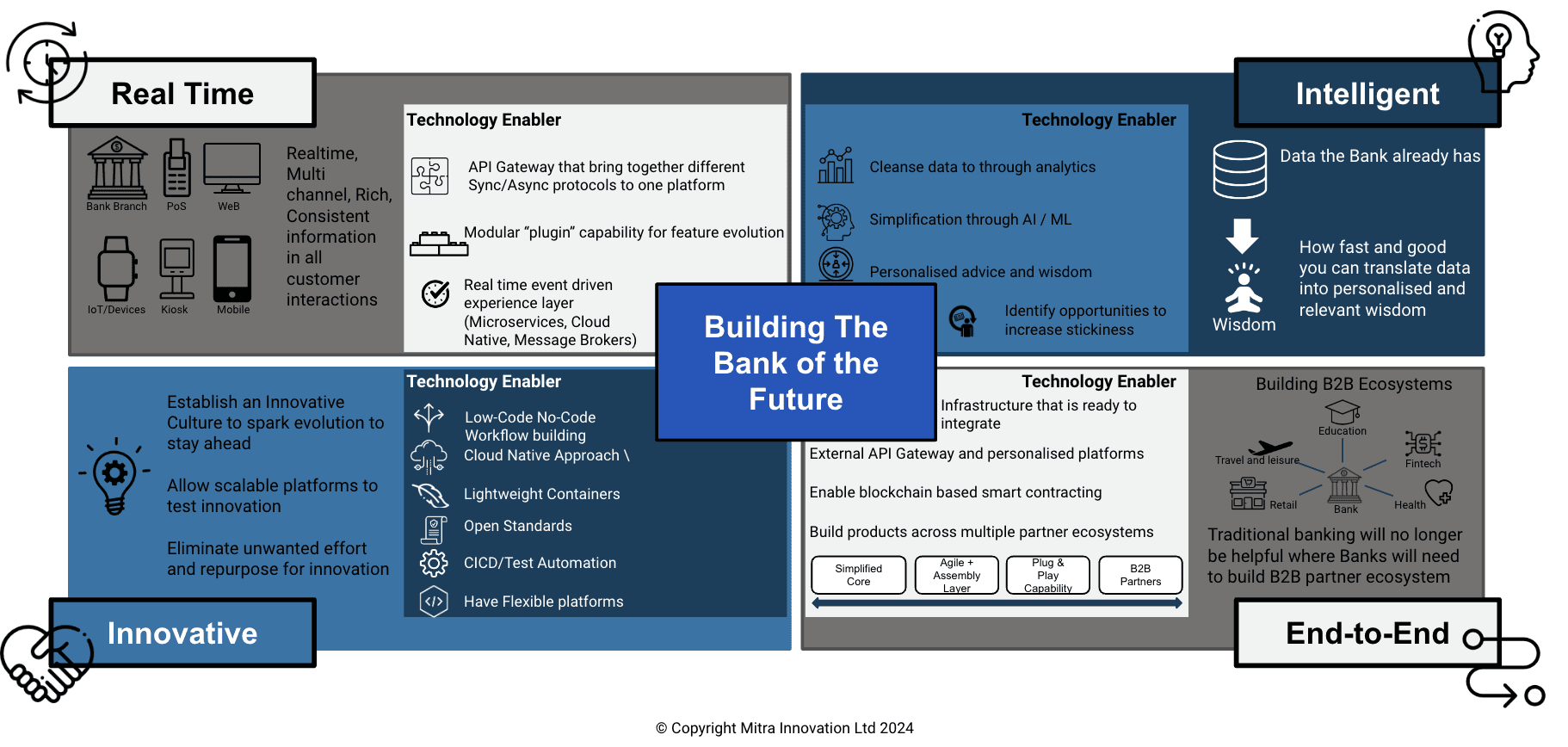

6.Bank of the Future

7.Bank of the Future

In the ever-evolving landscape of digital banking, APIs serve as the cornerstone of innovation and connectivity. Understanding your bank’s current position with the Mitra API Maturity Model not only allows you to evaluate your current digital capabilities but also empowers you to build a strategic path forward and be competitive in the age of AI. By understanding this model banks can choose to move up progressively or better yet leapfrog through the stages of API maturity.

For example if you are a bank that wants to jump from the Basic stage to Mature or even the Innovative stage we can definitely help you do that in the most efficient way possible and avoid you from some common pitfalls that would waste your banks time, money and effort.

Mitra AI’s Integration team has worked extensively in the banking industry in multiple regions such as Europe, Asia Middle East and Africa. We are experts in using API Management tools from popular vendors such as Azure, AWS, WSO2, Boomi and Mulesoft. With over a decade of experience and deep understanding of banking and integration spaces we are perfectly positioned to translate your bank’s business strategy into your technical strategy.